For Entrepreneurs, Business Owners &

Startups:

Learn How To Get $50K to $500K of

0% Interest Funding To Grow Your Business👇

Schedule a FREE Call Below To See If You Qualify👇

Unlock $50K+ Funding Using A Proven Credit Optimization System

Get low-interest working capital without relying on collateral, proof of income, or years of business history. We've already helped hundreds of business owners get funded.

134M+

in funds provided to startups and small

businesses

98%

of 1E9 Funds customers would

recommend us to a friend

2x+

Get 2x-5x more funding when you apply

with 1E9 Funds

Scale

Get cash available to fund your growth

No Hassle

No equity dilution

or giving up shares to get funding

Get Predictable Funding at 0% Interest with 1E9 Funds' Proven Method for Entrepreneurs

Transparent funding process, life-long

funding partners.

I just want to say I'm very thankful for 1E9 and their team! Before working with them I had no business credit, just a few decent personal credit limits. After working with them I was able to get over $125k in funding at 0%. I felt confident going through this process with their guidance.

- Edgar Geronimo

Real Estate Investor | AirBNB Entrepreneur

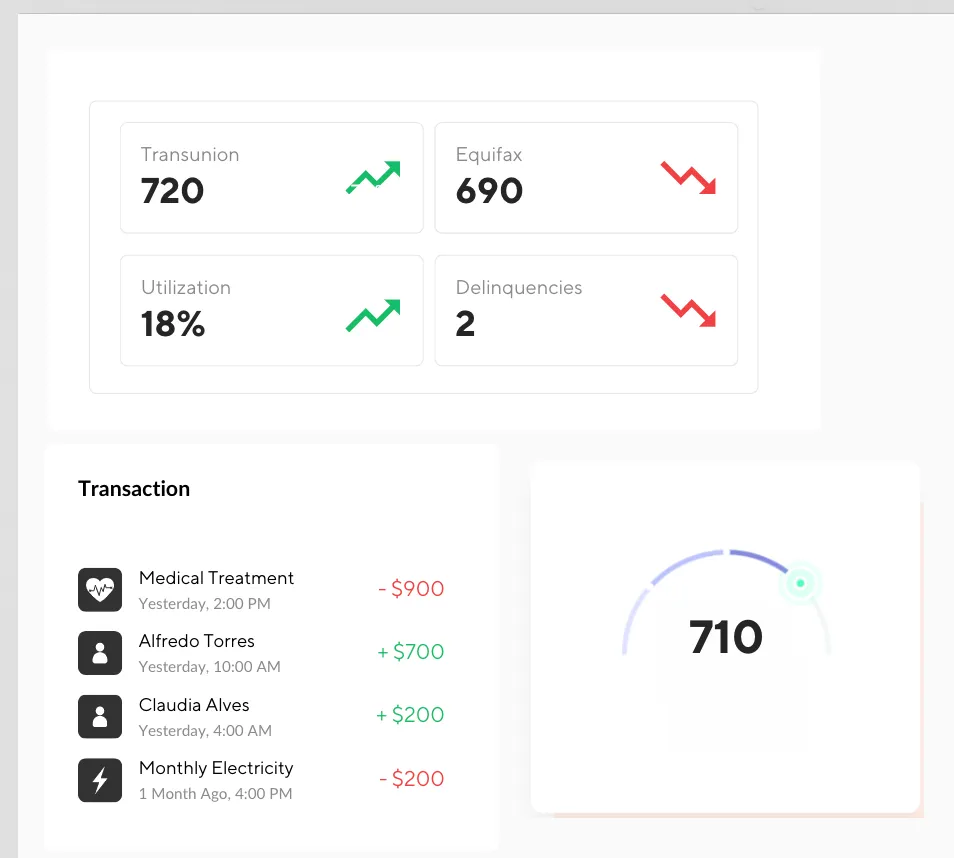

Share your personal credit details

We begin by gathering your personal credit information, which is a crucial factor in obtaining funding for your business.

Optimize your credit profile

Next, we work on building your business credit and credibility, turning your business into the perfect candidate for funding.

Get a large round of funding

We then submit the applications and connect you with our network of key-decision makers at banks to get you a large round of business funding.

Transparent funding process, life-long

funding partners.

I want to give a big shoutout to the 1E9 Funds team for helping me get approved for $200k in funding! Thank you for helping me scale my business. I was able to use the funds to build Amazon FBA store and Real Estate Wholesale Company.

- Arnulfo Nuño

Engineer | AirBNB & Amazon Entrepreneur

Frequently Asked

Questions

How does 1E9 Funds work?

1E9 Funds makes it simple to get access to reliable, predictable capital based entirely on your credit score, and not who you know or your revenue history. 1E9 Funds optimizes your personal credit profile data to get you access to large rounds of funding. Once your profile is optimized, we connect you to our network of key decision makers at Grade A banks. We can generally get you 2x-5x amount of business financing than if you were to apply yourself.

Am I eligible for 1E9 Funds?

We analyze and optimize your credit profile to get you the best possible terms. Businesses incorporated in the US that meet certain criteria, typically with at least $25,000+ monthly predictable revenue, may be eligible for a capital offer.

How long does it take to get funded?

Once we finish reviewing your credit profile, we'll build a personalized plan for you to get funded which generally takes 48-72 hours. Based off how complex your credit profile is, we can typically get you funded in as soon as 2 weeks if your profile is already optimized and ready to be submitted to our network. For more serious cases (i.e. prior bankruptcy), it can take 3-4 months. Generally, it'll take 4-6 weeks to get you funded.

How does the 0% interest work?

We act as long-term funding partners, and can get you 0% interest financing for 9-24 months on average through our network of lenders. If you continue to work with us for multiple funding rounds, we can help you extend the 0% interest for up to 60 months (or indefinitely). Often times, businesses need cash flow and upfront capital to grow, so the 0% interest is a great option for business owners who need the initial capital to get started, to invest in real estate or to purchase a lot of inventory.

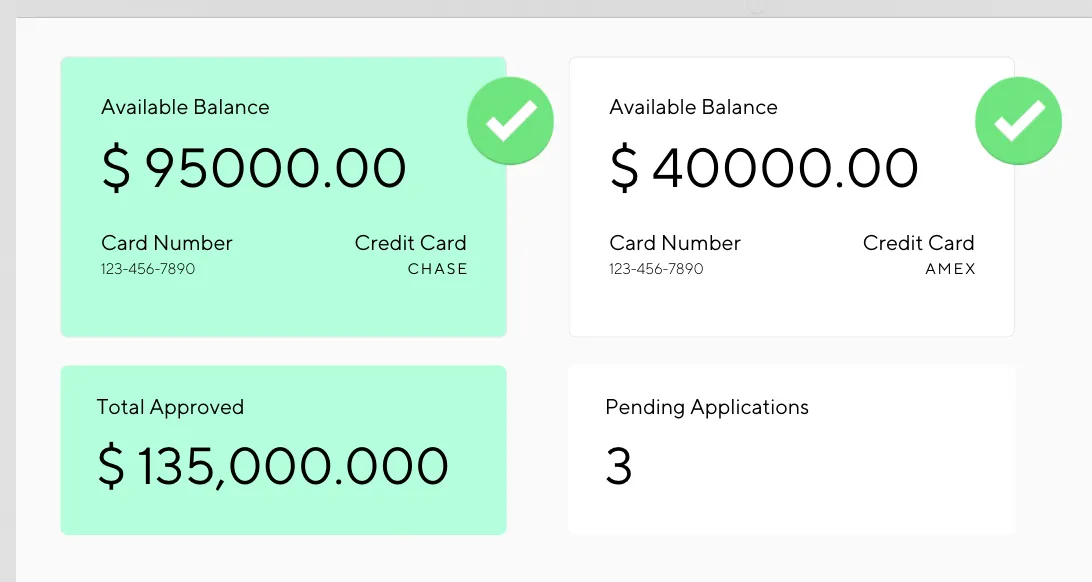

How much can I get funded?

We guarantee a minimum of $50,000 funded, or you don't pay. We aim to get as much funding for our clients as possible, so there is no hard limit. For new businesses, we aim for $50,000 to $250,000 funded. For more seasoned businesses and entrepreneurs, we aim for $250,000 to $1,000,000 in funding or more.

What are the costs and fees to use 1E9 funds?

Your cost of capital will be a single upfront service fee with a success fee that we collect based on the amount of funding we can get you. There are no compounding interest charges, requirements for personal collateral, or penalties for late payments when sales are slow. Your fee is determined based on factors such as the health of your business, projected revenue, and sales volume and is calculated as a percentage of your advance amount. For example, if your fee is 10% on a $50,000 minimum amount of funding, then your fee will be $5,000. We strive for transparency and simplicity in our pricing structure, so you know exactly what to expect. No surprises.

With 1E9 Funds, You Get:

✅ Optimized Personal Credit

Done-For-You

✅ Optimized Business Credit

Done-For-You

✅ Access to Nationwide Network of Lenders

All Access

✅ Personalized Credit Strategy Tailored To You

Done-For-You

✅ 1E9's Database of 0% Interest Funding Options

All Access

✅ Copy-And-Paste Formula To Get 50K+ Funded

Done-For-You

✅ Maximum Funding With Our Credit Expert Team

All Access

✅ Concierge-Style Service

All Access